Budget 2022: Fiscal consolidation shouldn’t be only focus, say SBI economists

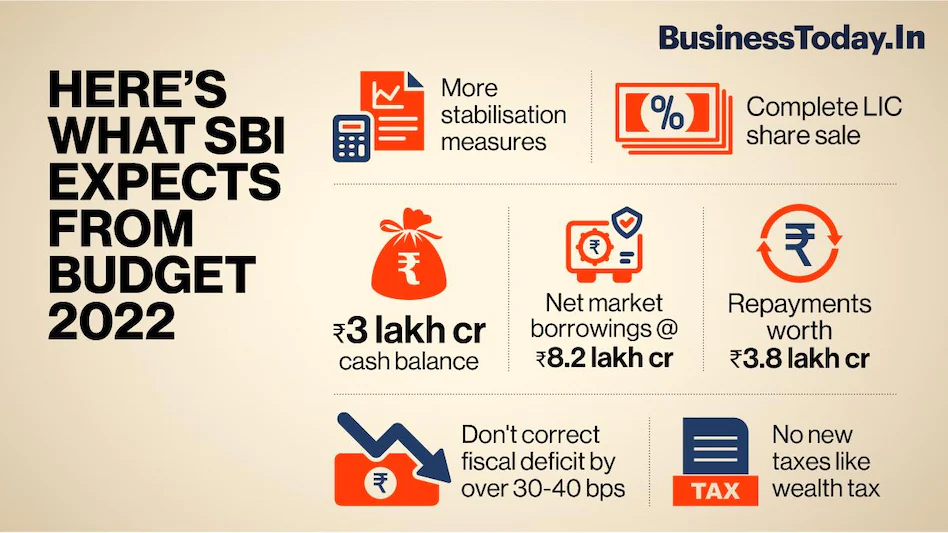

State Bank of India (SBI) economists have urged the Centre to not focus much on fiscal consolidation in the upcoming Budget 2022-23 as there is a need for more stabilisation measures to sustain economic recovery. SBI chief economist Soumya Kanti Ghosh said in a pre-Budget note that one of the best ways to begin this fiscal is to complete LIC share sale this fiscal.

He added this will repair the overstretched balance sheet which, in turn, will lower fiscal deficit to 6.3 per cent in FY23 and the exchequer will have a cash surplus of at least Rs 3 lakh crore. Ghosh further noted that the Union Budget should not correct fiscal deficit by over 30-40 basis points as most sectors still need support.

If the LIC share sale takes place through FY22, the cash balance of Rs 3 lakh crore can support a large part of the government’s fiscal deficit without taking recourse in market borrowings. In this case, net market borrowings of the Central government may stand at around Rs 8.2 lakh crore and with repayments of Rs 3.8 lakh crore.

The SBI pre-Budget note also cautioned the government against imposing new taxes like wealth tax at this point as it could do more harm than benefit. Assuming the government keeps the expenditure growth at 8 percent over FY22 estimates at Rs 38 lakh crore in FY23 and receipts (excluding borrowings and liabilities) would go up by 10.8 percent, this would lead to fiscal deficit of ~Rs 16.5 lakh crore or 6.3 per cent of GDP.

Overall gross borrowings by the Centre and states are expected to be around Rs 21 lakh crore and net borrowings at around Rs 14.8 lakh crore. The SBI chief economist also underscored that support mechanisms like the Reserve Bank of India’s Open Market Operations also seems unlikely in FY23. In FY22, the RBI did OMOs worth Rs 2.6 lakh crore to help the government borrowing programme without disruptions.

Meanwhile, Garware Technical Fibres Limited CFO Mukesh Surana believes that measures like lower GST, low surcharges and a relaxation of personal income tax will help in boosting consumption. “A lower GST, low surcharges and a relaxation of personal income tax will boost consumption, which will help the economy recover after the COVID-19 pandemic. It is also possible for the government to pursue its divestment to pursue its divestment strategy to boost the cash flow,” Surana said.

Surana further noted that the government should rationalise the long-term capital gains tax on equity and dividend tax. He also urged the government to remove the cap of Rs 7.5 lakh contribution for PF and NPS to ensure that retirement benefits are rewarded as per global trends.